Learn how Price Manipulation affects market behavior and why it is considered illegal in trading practices.

Price Manipulation in financial markets is the deliberate distortion of prices through deception, force, and false signals to steal profit from unsuspecting participants.

Price Manipulation is not strategy.

It is warfare disguised as trading.

It is the intentional bending of supply, demand, and perception until the price breaks in the manipulator’s favor.

In financial markets, Price Manipulation occurs when traders or institutions create artificial price movement that does not reflect real economic value.

The goal is simple: move the price, trap others, extract profit, and disappear before the smoke clears.

This behavior is illegal, aggressively prosecuted, and far more common than the public realizes.

WHAT PRICE MANIPULATION LOOKS LIKE IN REAL TIME

Price Manipulation thrives in speed, confusion, and imbalance.

It feeds on fear, greed, and delayed reactions.

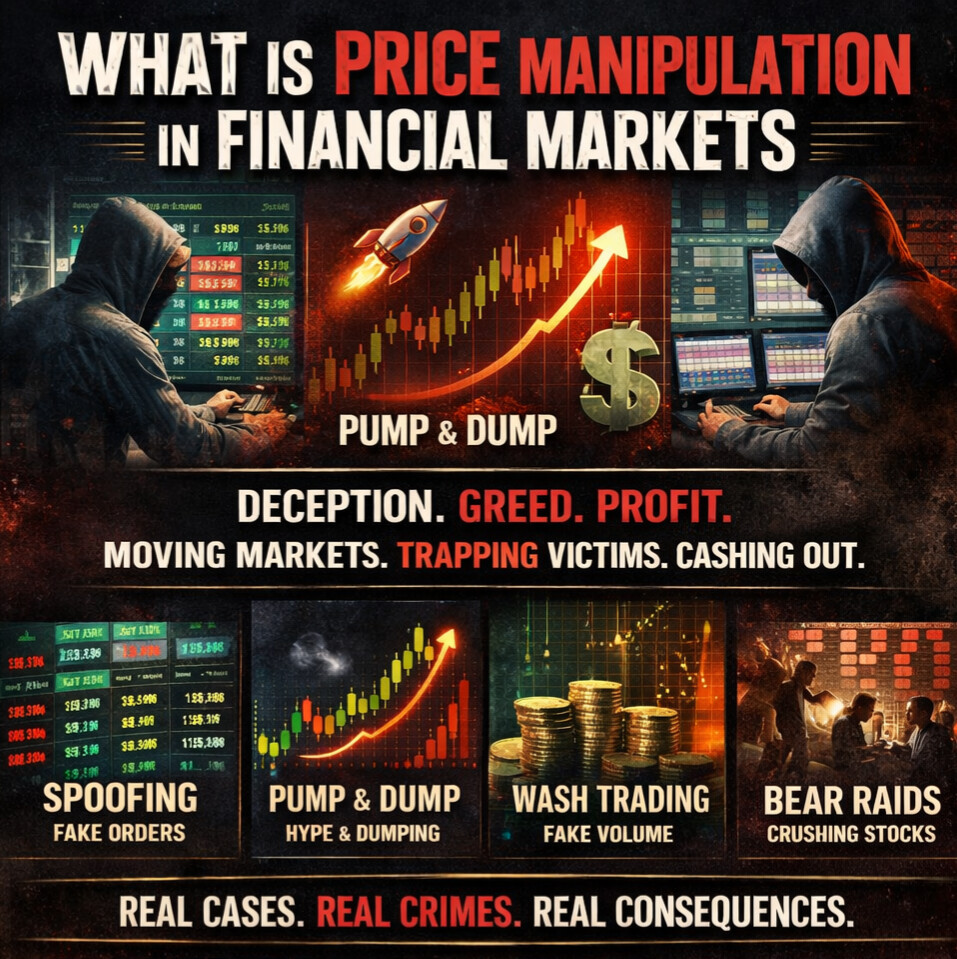

Common manipulation tactics include:

- Spoofing — placing massive fake orders to scare or lure traders, then canceling them

- Wash Trading — buying and selling the same asset to fake volume and momentum

- Pump and Dump — inflating price through hype, then dumping shares on the crowd

- Layering — stacking fake orders to manufacture market pressure

- Bear Raids — spreading panic to crush prices for profit

Each tactic creates a false reality inside the market. The price moves, not because value changed, but because perception was hijacked.

WHY PRICE MANIPULATION IS SO DANGEROUS

Price Manipulation destroys trust.

Without trust, markets rot from the inside.

Retail traders chase fake breakouts. Institutions front-run illusionary demand. Algorithms react to signals that were never real.

This is why regulators like the Securities and Exchange Commission and the Commodity Futures Trading Commission classify Price Manipulation as market abuse.

Manipulation doesn’t just steal money.

It rewires how markets behave.

REAL CASE STUDY: SPOOFING AS A WEAPON

In the first major spoofing conviction, a high-frequency trader used algorithms to flood futures markets with fake orders.

Those orders pushed prices just long enough for real trades to execute at distorted levels.

The result:

- Over $1.4 million in illegal profit

- Criminal conviction

- Federal prison sentence

The court ruled the behavior was not aggressive trading. It was intentional deception.

This case set the tone: Price Manipulation is fraud, not finesse.

REAL CASE STUDY: SOCIAL MEDIA PUMP-AND-DUMP

In 2022, multiple influencers were charged for hyping thinly traded stocks to followers.

They quietly bought first, promoted relentlessly, then sold without warning.

Regulators found:

- Over $100 million in combined profits

- Coordinated messaging across platforms

- Deliberate concealment of intent

The SEC called it “a classic pump-and-dump scheme dressed in modern clothes.”

The clothes change.

The crime does not.

HOW REGULATORS HUNT PRICE MANIPULATION

Modern surveillance is ruthless.

Exchanges, regulators, and clearing firms track everything.

They monitor:

- Order placement and cancellation speed

- Repetitive trading patterns

- Cross-market price distortions

- Sudden volume spikes without news

Advanced surveillance systems now flag manipulation in seconds, not weeks.

When caught, penalties include:

- Massive fines

- Trading bans

- Asset forfeiture

- Prison sentences

Price Manipulation leaves fingerprints.

And they do not wash off.

THE BRUTAL TRUTH ABOUT PRICE MANIPULATION

Price Manipulation exists because markets reward speed and punish hesitation.

Those who control perception control exits.

But every manipulator believes the same lie. That they are smarter than the system.

They are not.

- Markets remember.

- Regulators document.

- And eventually, the illusion collapses.

Price Manipulation is not power. It is borrowed control — and the bill always comes due.