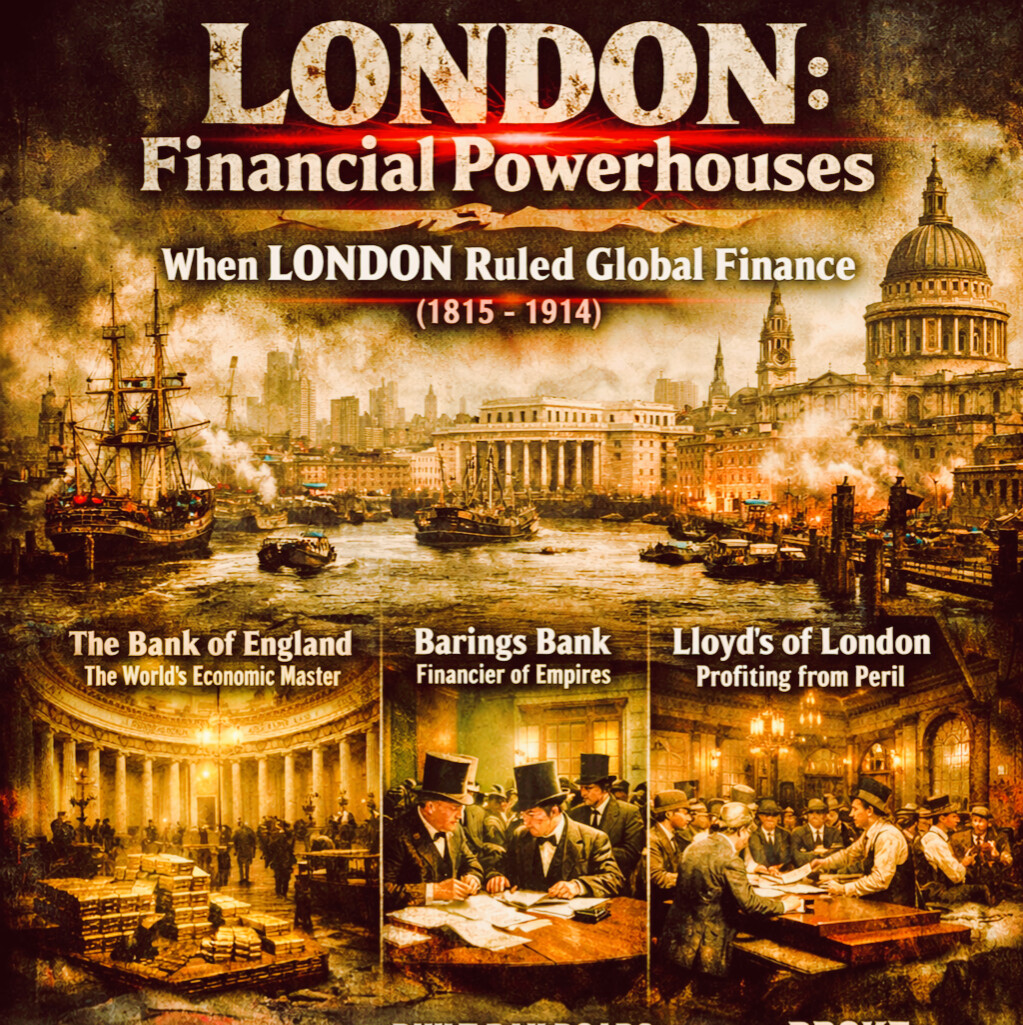

Discover how London became the center of financial power, altering global trade dynamics between 1815 and 1914.

There was a time when LONDON didn’t ask permission. It took control.

From roughly 1815 to 1914, LONDON was not just a financial center. It was the switchboard of the world economy. Money moved when LONDON said it could.

Trade expanded when LONDON allowed it. Nations rose or stalled based on decisions made inside a single square mile.

This wasn’t polite capitalism. This was financial domination.

When LONDON Ruled Global Finance

After the defeat of Napoleon in 1815, the old European order lay broken. Empires were exhausted. Treasuries were empty. Into that vacuum stepped LONDON, armed with capital, ships, contracts, and a ruthless understanding of leverage.

By the mid-19th century, nearly everything serious ran through the City of London. Trade deals. Insurance policies. Shipping manifests. Sovereign loans.

If you wanted to build a railroad in Argentina, dig a canal in Egypt, or fight a war in Europe, you went to LONDON.

And you paid the price.

Capital flowed outward from LONDON, but control flowed inward. Interest rates were weapons. Credit was conditional. Miss a payment, and markets closed overnight. Entire governments learned this the hard way.

The Bank That Set the World’s Pulse

At the center stood the Bank of England. More than a central bank, it was the referee of global money.

During the gold standard era, LONDON effectively dictated monetary discipline. Gold moved through its vaults. Exchange rates bent to its policies. A tightening in LONDON could trigger recessions thousands of miles away. A loosening could ignite booms just as fast.

This was power without elections. No armies. No flags. Just numbers, signatures, and silence when loans were denied.

Barings Bank and the Business of Empires

If the Bank of England was the engine, Barings Bank was one of the sharpest blades.

Barings financed wars. It underwrote governments. It funneled British capital into Latin America, North America, and beyond. Railroads cut through continents because Barings said yes. When it said no, projects died.

This wasn’t charity. This was extraction dressed as development. Countries grew dependent on LONDON money, locked into debt structures that favored British investors and British interests.

Development happened, but on LONDON’s terms.

Lloyd’s of London and the Price of Risk

Nothing moved without insurance, and no one insured risk like Lloyd’s of London.

Ships, cargo, slave routes, colonial ventures, wars at sea. Lloyd’s priced danger and made it profitable. If Lloyd’s refused coverage, voyages didn’t sail. Empires stalled. Trade routes collapsed.

This is how LONDON controlled shipping without owning every ship. Risk itself became a commodity, traded and manipulated in coffee houses and underwriting rooms.

Financing War, Shaping the World

LONDON financed conflicts it never fought directly. It funded allies, armed empires, and supplied credit lines that decided who could stay in the fight. From European wars to colonial expansion, British capital quietly dictated outcomes.

Railroads carved up India. Canals reshaped Africa and the Middle East. Ports exploded with activity. All of it tied back to contracts written in LONDON.

This wasn’t neutral finance. It was strategic. Lending wasn’t about growth. It was about control.

The Brutal Truth

Here’s what polite history avoids saying:

LONDON didn’t just fund development. It selected winners and buried losers.

If you aligned with LONDON, capital flowed. If you resisted, you were starved. Markets closed. Insurance vanished. Trade dried up. Violence followed, not always with guns, but with hunger, unemployment, and collapse.

This was financial power at its most dangerous. Clean hands. Bloody outcomes.

By 1914, the system cracked under its own weight. War shattered the old order. New financial centers rose. But for a century, LONDON stood alone at the top.

Not as a city.

As a decision-maker for the world.

And the world paid for it.