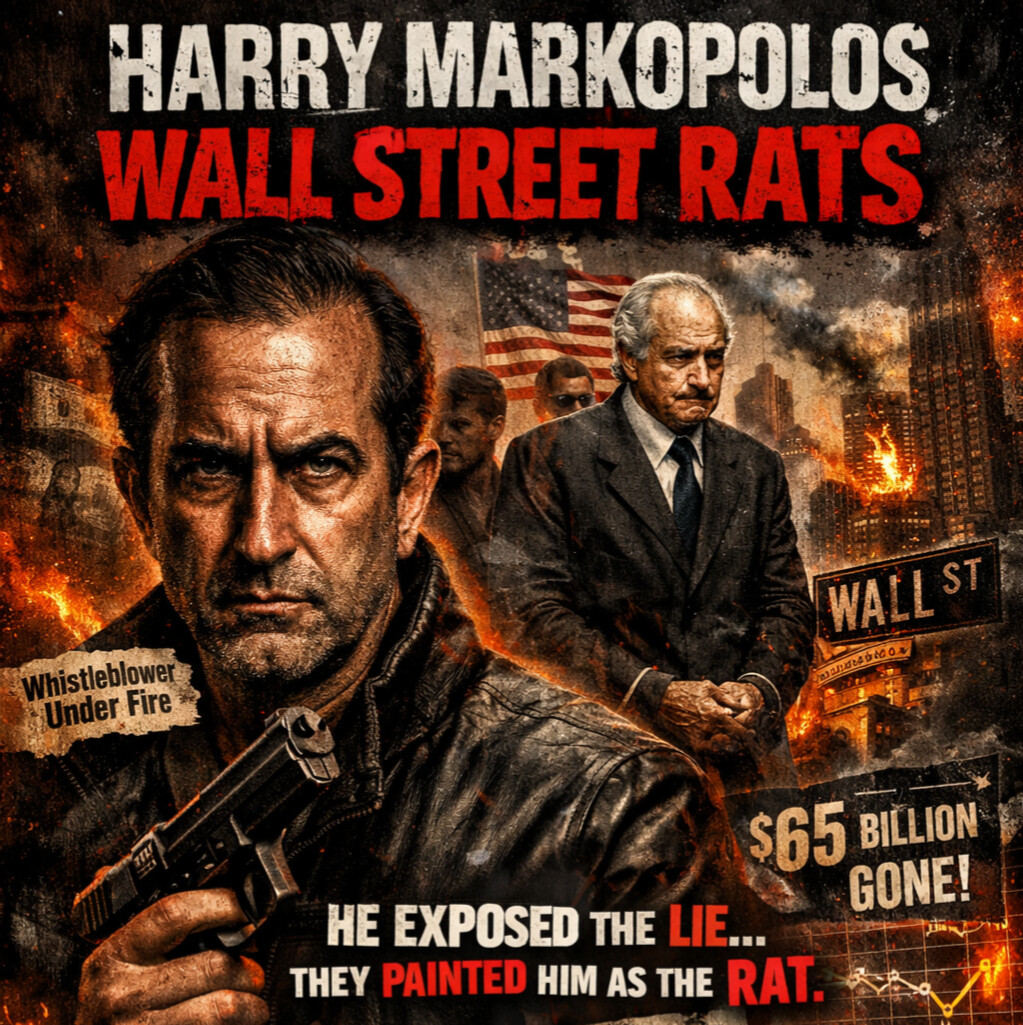

Learn how Harry Markopolos challenged Wall Street norms against overwhelming odds, armed only with numbers and tenacity.

(Harry Markopolos) – Wall Street loves a hero only after the blood is washed off the floor. Before that, it eats its own.

Harry Markopolos learned that the hard way. He didn’t get a cape. He got a target. While the financial world bowed to power, he hunted truth. And for that, he was treated like a rat.

Not a savior.

Not a whistleblower.

A problem.

Harry Markopolos: Built on Math, Not Mercy

Harry Markopolos wasn’t born into fame or fortune. He came up the hard way. Greek-American, blue-collar roots, trained as a CPA and financial analyst. Numbers were his weapon. Logic was his shield.

In the 1990s, he worked at Rampart Investment Management, building complex derivatives strategies. That’s when something snapped into focus.

- Returns that never dipped.

- Volatility that didn’t exist.

- Performance curves that laughed at market reality.

Markopolos later said:

“I knew it was a fraud within five minutes.”

Five minutes. That’s all it took for the math to scream what Wall Street refused to hear.

Exposing Bernie Madoff: One Man vs. the Machine

The fraud belonged to Bernie Madoff.

The silence belonged to everyone else.

Markopolos didn’t whisper. He documented. He built case after case. He handed the SEC a blueprint titled “The World’s Largest Hedge Fund Is a Fraud.”

- Not once.

- Not twice.

- Six separate times.

From 1999 to 2008, he begged regulators to act. He laid out the math. He explained the mechanics. He showed how the returns were statistically impossible.

The response?

Nothing.

Later, Markopolos would say:

“The SEC didn’t just miss it. They didn’t want to see it.”

While Wall Street toasted Madoff, Markopolos was ostracized. Clients vanished. Colleagues distanced themselves. He received death threats. The FBI advised him to carry a gun.

This is what truth costs in a corrupt system.

$65 Billion of Silence

When Madoff finally collapsed in 2008, the damage was already done.

- $65 billion evaporated.

- Pension funds destroyed.

- Charities wiped out.

- Lives shattered.

This wasn’t a clever con that fooled everyone. This was a fraud that survived because the system protected power and punished disruption.

- Markopolos didn’t fail.

- The system did.

And instead of praise, he was painted as bitter. Obsessive. Dangerous. A Wall Street rat gnawing at the foundation.

That label stuck because it was useful.

The Impact: A Hero Treated Like a Threat

After the collapse, Markopolos testified before Congress. His words were brutal:

“If you want to catch fraud, you have to understand math. The SEC doesn’t.”

His work forced uncomfortable reforms. The SEC restructured its enforcement division. Whistleblower programs expanded. Financial oversight became louder, if not smarter.

But Wall Street never forgave him.

Why?

Because he exposed the violence hiding in plain sight. The kind that ruins lives without pulling a trigger.

He proved that the market wasn’t broken.

It was complicit.

Wall Street Rats vs. Wall Street Heroes

Here’s the truth no one likes to print:

- Harry Markopolos was dangerous.

- Not because he lied.

- Because he told the truth with evidence.

Wall Street calls people like him rats because rats survive disasters. They sense collapse early. They run toward exits others deny exist.

- Markopolos didn’t just expose Madoff.

- He exposed the culture.

A culture that rewards silence.

A culture that buries math.

A culture that eats its own heroes alive.

Final Word

History will remember HARRY MARKOPOLOS as the man who tried to stop the biggest Ponzi scheme in history while everyone else looked away.

Wall Street saw a rat.

The rest of us should see something else entirely.

A man who chose truth over comfort.

Math over myth.

And paid for it in full.